Medical Insurance Verification: A Comprehensive Guide

Have you ever faced unexpected medical bills due to unclear insurance coverage? You’re not alone. In fact, a significant number of patients and healthcare providers struggle with insurance-related issues. Accurate insurance verification is the key to avoiding these pitfalls. This guide will explore the crucial role of medical insurance verification in ensuring seamless healthcare experiences, from verifying medical insurance eligibility to streamlining billing processes.

Table of Contents

ToggleWhat is Insurance Eligibility Verification?

Insurance verification is the process of confirming a patient’s insurance coverage and benefits before services are provided. This critical step ensures that healthcare providers receive proper reimbursementfrom insurance companies. Medical insurance verification helps in identifying the patient’s coverage details, including what services are covered, the extent of coverage, and any out-of-pocket costs that the patient may incur.

The primary purpose of insurance verification in medical billing is to minimize claim denials and delays in payment by confirming the patient’s eligibility for coverage. This process involves checking the patient’s medical insurance eligibility status, which helps in planning and delivering healthcare services efficiently.

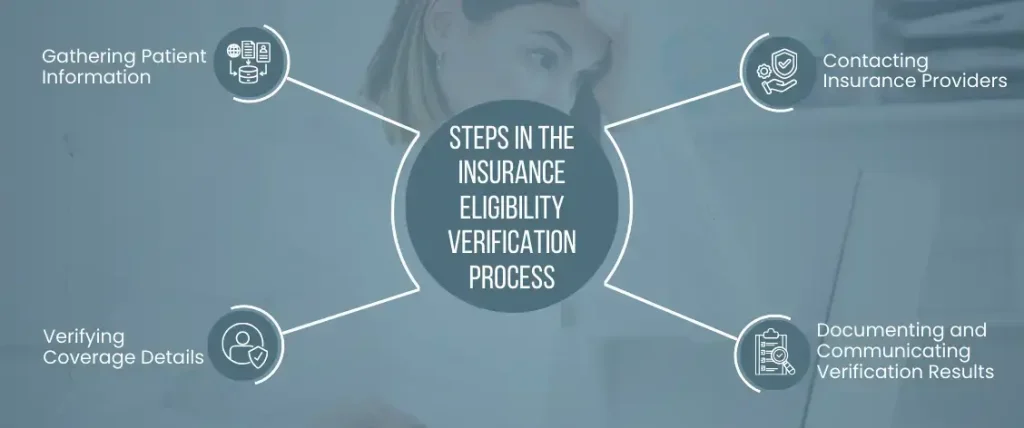

Steps in the Insurance Eligibility Verification Process

Gathering Patient Information

The first step in insurance verification is collecting accurate and comprehensive patient information. This includes the patient’s full name, date of birth, insurance ID number, and contact details. Ensuring that this data is correct is crucial for effective medical insurance verification

Contacting Insurance Providers

After gathering patient information, the next step is to contact the insurance providers. This involves reaching out to the insurance companies to verify the patient’s medical insurance eligibility. This step ensures that the patient’s insurance is active and provides details on what services are covered.

Verifying Coverage Details

In this step, detailed information about the patient’s coverage is confirmed. Insurance verification in medical billing includes checking:

- In-Network vs. Out-of-Network Benefits: Determining whether the healthcare provider is within the patient’s insurance network to avoid higher out-of-pocket expenses.

- Co-pays, Deductibles, and Co-insurance: Understanding the patient’s financial responsibilities, including co-pays, deductibles, and co-insurance amounts.

- Authorization Requirements: Identifying if prior authorization is needed for specific procedures or treatments to ensure coverage.

Documenting and Communicating Verification Results

Accurately recording the results of the insurance verification process is essential. This involves documenting the verified information and communicating it to the relevant departments within the healthcare facility. Effective communication ensures that all parties are aware of the patient’s medical insurance eligibility and coverage details.

Common Challenges in Insurance Eligibility Verification

Incomplete or Incorrect Patient Information

One of the main challenges in insurance verification is dealing with incomplete or incorrect patient information. This can lead to delays and errors in the medical insurance verification process.

Complex Insurance Policies

The complexity of various medical insurance policies can make insurance verification in medical billing challenging. Each insurance plan has different coverage details, co-pays, deductibles, and authorization requirements, which can complicate the verification process.

Timely Access to Insurance Information

Accessing up-to-date insurance information promptly is another challenge. Delays in obtaining accurate data from insurance providers can hinder the insurance verification process and affect the timely delivery of healthcare services.

Solutions to Overcome These Challenges

- Training Staff: Regular training ensures that staff are knowledgeable about the latest procedures and requirements for insurance verification.

- Using Advanced Tools: Leveraging technology, such as eligibility verification software and real-time verification solutions, can streamline the medical insurance verification process.

- Standardizing Procedures: Developing standardized procedures for insurance verification in medical billing helps in reducing errors and improving efficiency.

Advantages of the Insurance Verification Process

- Reduces Claim Denials: Accurate insurance verification ensures that services provided are covered by the patient’s medical insurance, significantly reducing the likelihood of claim denials.

- Improves Cash Flow: By confirming medical insurance eligibility before services are rendered, healthcare providers can expedite the billing process and receive timely reimbursements, enhancing overall cash flow.

- Enhances Patient Satisfaction: Clear and accurate insurance verification helps patients understand their coverage and out-of-pocket costs upfront, leading to a better healthcare experience and increased satisfaction.

- Streamlines Administrative Processes: Insurance verification in medical billing reduces administrative burdens by automating and standardizing the verification process, allowing staff to focus on more critical tasks.

- Ensures Compliance: Proper medical insurance verification ensures adherence to insurance policies and regulations, minimizing legal and financial risks for healthcare providers.

- Facilitates Informed Decision-Making: Providers and patients can make informed decisions regarding treatment plans and financial arrangements based on verified medical insurance eligibility.

- Decreases Billing Errors: Thorough insurance verification minimizes billing errors by ensuring that all provided services align with the patient’s coverage, leading to more accurate billing and fewer rejections.

- Optimizes Resource Allocation: Efficient insurance verification allows healthcare facilities to better allocate resources and plan for patient care, improving overall operational efficiency.

The Role of Medical Billing Companies in Insurance Eligibility Verification

Outsourcing Eligibility Verification Services

Tools and Technologies for Insurance Eligibility Verification

Eligibility Verification Software

Eligibility verification software is a specialized tool designed to streamline the insurance verification process. This software automates the verification of medical insurance eligibility, reducing the manual effort involved and minimizing errors. By using eligibility verification software, healthcare providers can ensure accurate and efficient medical insurance verification.

Integrated Practice Management Systems

Integrated practice management systems combine various administrative and clinical functions into a single platform. These systems include insurance verification features, enabling healthcare providers to manage patient information, schedule appointments, and verify medical insurance eligibility all in one place. This integration enhances the overall efficiency of insurance verification in medical billing.

Real-time Eligibility Verification Solutions

Real-time eligibility verification solutions allow healthcare providers to instantly check a patient’s medical insurance eligibility. These solutions connect directly with insurance providers to provide immediate verification results. By using real-time solutions, providers can avoid delays and ensure accurate insurance verification at the point of service.

Benefits of Using Advanced Tools

Utilizing advanced tools for insurance verification offers several benefits:

- Increased Accuracy: Automation reduces the risk of human errors in the medical insurance verification process.

- Time Efficiency: Advanced tools speed up the insurance verification process, allowing for quicker patient intake and service delivery.

- Improved Cash Flow: Accurate and timely insurance verification leads to fewer claim denials and faster reimbursements, enhancing the financial health of healthcare providers.

- Enhanced Patient Experience: Efficient medical insurance verification ensures that patients are aware of their coverage and out-of-pocket costs, leading to better satisfaction and trust in the healthcare provider.

How Does The Whole Insurance Eligibility Verification Benefit the Patient?

- Reduces Financial Surprises: Accurate insurance verification ensures patients know their coverage details and out-of-pocket costs upfront, reducing unexpected medical bills.

- Ensures Coverage: By confirming medical insurance eligibility beforehand, patients receive the treatments they need without worrying about insurance denials.

- Enhances Service Quality: Efficient insurance verification in medical billing allows healthcare providers to focus more on patient care rather than administrative tasks.

- Improves Appointment Scheduling: Verifying medical insurance coverage ahead of time streamlines appointment scheduling, reducing wait times and rescheduling due to insurance issues.

- Promotes Informed Decisions: Patients can make better healthcare decisions with a clear understanding of their medical insurance benefits and financial responsibilities.

- Increases Peace of Mind: Knowing that medical insurance verification is handled accurately, patients can concentrate on their health and recovery rather than worrying about coverage issues.

- Facilitates Access to Necessary Care: Efficient insurance verification ensures that patients can access necessary care without delays due to unresolved insurance matters.

Final Words

Accurate insurance verification is more crucial than ever. By ensuring precise medical insurance verification, providers can significantly reduce claim denials, improve cash flow, and enhance patient satisfaction. However, the complexities of medical insurance eligibility and insurance verification in medical billing can be challenging to manage in-house.

At Medmax RCM, we specialize in streamlining the insurance verification process, offering expert services to ensure your claims are processed efficiently and accurately. Let us handle the intricacies of medical insurance verification so you can focus on delivering exceptional patient care. Contact Medmax RCM today to learn more about how our outsourced insurance verification services can benefit your practice and optimize your billing processes.