What is a Superbill, and How Do They Work?

Superbill stands out as a critical document that bridges the gap between healthcare providers and insurance companies in medical billing. Essentially, it serves as a comprehensive record of services rendered during a patient visit, outlining the details necessary for reimbursement from insurance providers.

Table of Contents

ToggleWhat is a Superbill?

Importance of Superbills in Healthcare

Its play a pivotal role in facilitating the reimbursement process between healthcare providers and insurance companies. By meticulously documenting the services provided and corresponding codes, Superbills ensures accurate billing and expedites the claims process, thereby streamlining reimbursement for both parties involved.

Moreover, Superbills empowers patients by offering transparency regarding the services received and associated costs. With a clear understanding of the charges incurred, patients can make informed decisions regarding their healthcare and navigate the complexities of insurance coverage more effectively.

Differences Between Superbills and Standard Medical Bills

Understanding the disparities between Superbills and standard medical bills is crucial for navigating the intricacies of healthcare billing effectively. While both documents serve the purpose of documenting services rendered during a patient visit, they differ significantly in their format, content, and utility.

Format and Structure

Superbills are structured as standardized forms that capture specific details essential for reimbursement from insurance providers. They typically include sections for patient demographics, provider information, dates of service, and itemized lists of procedures or services rendered, each identified by its corresponding Current Procedural Terminology (CPT) code. Additionally, it contain diagnosis codes based on the International Classification of Diseases (ICD-10), providing a comprehensive overview of the patient’s condition or reason for the visit.

Content and Detail

Utility and Reimbursement

The primary purpose of superbill reimbursement is to facilitate the reimbursement process between healthcare providers and insurance companies. By providing a detailed breakdown of services rendered and associated codes, Superbills expedites the claims process, minimizing the risk of claim denials and reimbursement delays.

Additionally, superbill reimbursement empowers patients by offering transparency regarding the services received and associated costs, enabling them to navigate insurance coverage more effectively. Standard medical bills fulfill a similar function in documenting the charges incurred during a patient visit. However, they may lack the specificity and detailed information found in Superbills, potentially leading to discrepancies or challenges in the reimbursement process.

How Does a Superbill Work?

Understanding how Superbills function is crucial for providers and patients to ensure smooth reimbursement and accurate service documentation.

Process of Creating a Superbill

Submission Superbill to Insurance Companies

After completion, the insurance superbill is sent to the patient’s insurer. Insurers review it for coverage eligibility and process claims accordingly.

Patient’s Role in the Process

Patients must ensure accurate insurance details and review the Superbill for errors, actively participating in the billing process.

The Role of Superbills in Medical Billing

It plays a pivotal role in modern medical billing, revolutionizing the way healthcare providers document and process services for reimbursement.

Comparison with Traditional Medical Billing

Traditional medical billing methods often involve cumbersome paperwork and manual data entry, leading to inefficiencies and errors. In contrast, Superbills streamline the billing process by providing standardized forms that capture essential details of patient visits, services rendered, and associated charges. This structured approach enhances accuracy, reduces administrative burden, and accelerates reimbursement, making Superbills a preferred choice for healthcare providers seeking efficiency in medical billing practices.

Advantages of Using Superbills

Increased Efficiency: Superbills expedite the billing process by providing a standardized template for documenting services and charges. This streamlines administrative tasks, reduces errors, and enhances overall efficiency in medical billing operations.

Enhanced Accuracy

Optimized Reimbursement

Superbills facilitate prompt reimbursement from insurance companies by providing comprehensive documentation of billable services and associated charges. Superbill reimbursement enhances the revenue cycle management process for healthcare providers, ensuring timely payment for services rendered.

Improved Patient Experience

By streamlining the billing process and minimizing billing errors, Superbills contribute to a more positive patient experience. Patients benefit from transparent and accurate billing statements, which promote trust and confidence in their healthcare providers.

Customizable Templates

Superbills can be customized to meet the specific needs of different healthcare specialties and practice settings. Providers can tailor Superbill templates to include specialty-specific procedures, diagnosis codes, and billing requirements, ensuring compliance with regulatory standards and maximizing reimbursement opportunities.

Integration with Electronic Health Records (EHR):

What is a Superbill for Therapy?

Understanding Superbill Insurance

Superbill insurance is essential for patients who receive out-of-network care and need to seek reimbursement from their insurance companies. A superbill is a detailed receipt that includes all the necessary information for the insurance superbill process to work smoothly. Understanding how superbill insurance works can help patients receive the reimbursements they are entitled to.

How to Use Superbill Insurance for Reimbursement?

Collecting Your Superbill

After your visit, request a superbill from your healthcare provider. Ensure it includes all necessary details such as CPT codes, ICD-10 diagnosis codes, and itemized charges for your superbill insurance claim.

Submitting to Insurance

Submit the superbill to your insurance company along with any required claim forms The insurance superbill must be accurate and complete for the superbill insurance process to be successful.

Tracking Your Claim

Follow up with your insurance company to track the status of your superbill insurance claim. Ensure all provided information in the insurance superbill is accurate to avoid delays.

Superbill Reimbursement - Maximizing Your Returns

Steps to Achieve Superbill Reimbursement

Superbill reimbursement is the process of getting reimbursed by your insurance company for services provided by an out-of-network healthcare provider. To ensure successful superbill reimbursement, patients must follow the proper steps and be aware of common challenges.

Accurate Superbill Submission

Ensure your superbill is accurate and complete before submitting it for superbill reimbursement. This includes verifying all CPT codes and ICD-10 diagnosis codes on your insurance superbill.

Understanding Your Insurance Policy

Review your insurance policy to understand what services are covered and the superbill reimbursement rates. Knowing your policy helps manage expectations for superbill reimbursement.

Follow-Up and Appeals

If your superbill reimbursement claim is denied, follow up or file an appeal. Provide additional documentation or clarification for your insurance superbill as needed to support your claim for superbill reimbursement.

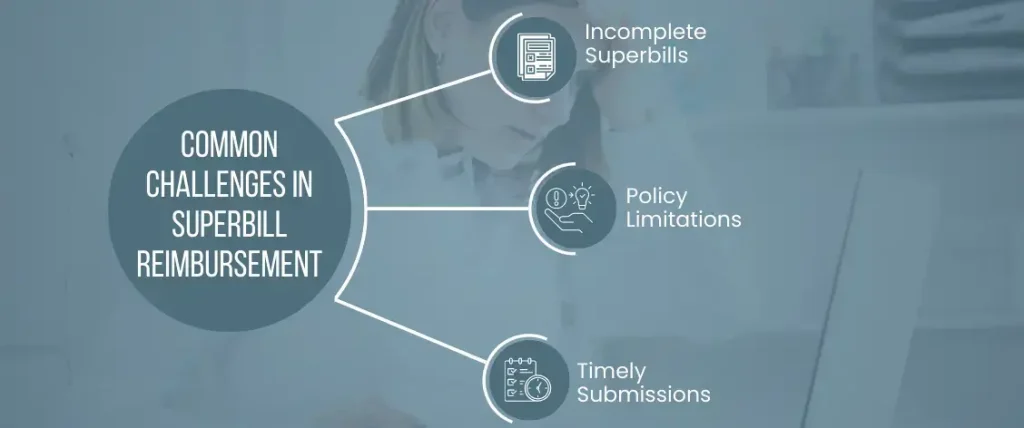

Common Challenges in Superbill Reimbursement

Incomplete Superbills

Incomplete or inaccurate superbills can delay or result in denied superbill reimbursement claims. Ensure your insurance superbill is thorough and accurate.

Policy Limitations

Some insurance policies have specific limitations on superbill reimbursement. Understanding these limitations is crucial for successful insurance superbill claims.

Timely Submissions

Submit your superbill and claim forms promptly to avoid missing any deadlines set by your insurance company. Timely submissions are key to efficient superbill reimbursement.

Final Words

Its play a crucial role in modern medical billing, streamlining the process for both healthcare providers and patients. By understanding superbill insurance and the steps required for successful superbill reimbursement, patients can ensure they receive the compensation they deserve for out-of-network care.

Accurate documentation, timely submission, and thorough understanding of insurance policies are key to navigating the intricacies of superbill insurance effectively. Using the benefits of Superbills leads to improved efficiency, accuracy, and financial management in the healthcare billing process.

Emily Thompson

Emily Thompson is a Revenue Cycle Management (RCM) Specialist with extensive experience in the medical billing industry. She helps healthcare organizations and medical billing companies improve claim efficiency, reduce A/R backlogs, and implement data-driven RCM strategies. Emily’s articles focus on end-to-end medical billing services, denial prevention, and technology-driven revenue optimization for healthcare practices across the U.S.