Understanding Your Hospital’s Itemized Bill

Table of Contents

ToggleUnderstanding an Itemized Bill from a Hospital

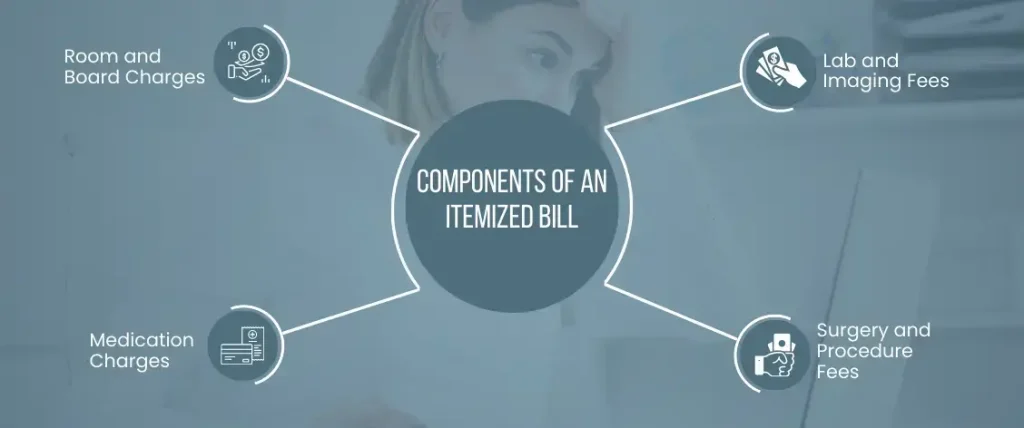

What is an itemized bill? When you receive a bill from a hospital, it’s important to review it carefully to make sure you understand all of the charges. An itemized bill is a detailed breakdown of all the charges associated with your hospital stay, including room and board charges, medication charges, lab and imaging fees, and surgery and procedure fees. Understanding your itemized bill can help you avoid overpaying for services you didn’t receive and catch any billing errors.

Components of an Itemized Bill

An itemized bill from a hospital typically includes charges for room and board, medication, lab and imaging fees, and surgery and procedure fees. Room and board charges cover the cost of your hospital room, meals, and other amenities. Medication charges include the cost of any drugs you were prescribed during your stay. Lab and imaging fees cover the cost of any lab tests, X-rays, or other diagnostic tests that were ordered. Surgery and procedure fees cover the cost of any surgeries or medical procedures you received during your hospital stay.

Room and Board Charges

Room and board charges are a significant part of any hospital bill, as they cover the cost of your room, meals, and other amenities. The charges can vary based on the type of room you were in, the level of care you received, and the hospital’s location. It’s important to review these charges carefully to ensure you were not overcharged and that the charges match the type of room you were in and the level of care you received.

Medication Charges

Medication charges on a hospital itemized bill include the cost of any drugs or medications you were prescribed during your stay. These charges can be significant, especially if you were prescribed expensive medications. It’s important to review these charges carefully to ensure you were not overcharged and that the medications were necessary for your treatment.

Lab and Imaging Fees

Lab and imaging fees cover the cost of any lab tests, X-rays, or other diagnostic tests that were ordered during your hospital stay. These charges can add up quickly, especially if you required multiple tests or if the tests were complex. It’s important to review these charges carefully to ensure you were not overcharged and that the tests were necessary for your treatment.

Surgery and Procedure Fees

Surgery and procedure fees cover the cost of any surgeries or medical procedures you received during your hospital stay. These charges can be significant, especially if you require complex surgeries or procedures. It’s important to review these charges carefully to ensure you were not overcharged and that the procedures were necessary for your treatment.

How are Charges Calculated?

Hospitals use a charge master to determine how much to charge for various services. The charge master is a list of prices for all the services provided by the hospital. Insurance contracts also play a role in determining how much you will be charged for services. Negotiated rates between your insurance company and the hospital can reduce the amount you owe. Payment policies, such as discounts for paying in cash or setting up a payment plan, may also affect the final amount you owe.

Requesting an Itemized Bill

Requesting an itemized bill is an important step in understanding your hospital charges. An itemized bill breaks down the charges for each service you received, making it easier to identify any errors or overcharges. It’s important to review the itemized bill carefully and dispute any incorrect charges.

Common Billing Errors to Watch For

Billing errors can occur when a hospital charges you for services you didn’t receive or when the charges on your itemized bill don’t match the services you received. Common billing errors to watch for include duplicate charges, incorrect billing codes, charges for services not rendered, and unbundling of charges.

Duplicate Charges

Duplicate charges occur when a hospital bills you for the same service more than once. These errors can be difficult to catch, especially if the charges are spread out over several pages of the itemized bill. It’s important to review your itemized bill carefully to ensure you were not charged twice for the same service.

Incorrect Billing Codes

Incorrect billing codes occur when a hospital bills you for the wrong service or procedure. This can happen if there is a mistake in the coding or if the code is outdated. It’s important to review your itemized bill carefully to ensure the billing codes match the services you received.

Charges for Services Not Rendered

Charges for services not rendered occur when a hospital bills you for a service or procedure that you did not receive. This can happen if there is a mistake in the billing or if the hospital is attempting to overcharge you. It’s important to review your itemized bill carefully to ensure you were not billed for any services you did not receive.

Unbundling of Charges

Unbundling of charges occurs when a hospital separates charges that should be billed together into separate charges. This can result in higher charges for patients and can make it difficult to compare prices across hospitals. It’s important to review your itemized bill carefully to ensure you were not overcharged due to unbundling of charges.

How to Dispute a Hospital Bill?

If you find an error on your hospital itemized bill or believe you were charged too much, you can dispute the charges. Start by contacting the hospital’s billing department to explain the error or dispute the charges. If you are unable to resolve the issue with the hospital, you can file a complaint with your insurance company or seek help from a patient advocate. You may also consider filing a grievance with the state department of health.

Contacting the Billing Department

If you have any concerns about your medical itemized bill or insurance coverage, the first step is to contact the billing department of your healthcare provider. The billing department can help you understand your medical charges, provide explanations of benefits, and assist you with payment options. You can typically find the contact information for the billing department on your medical itemized bill or by contacting the healthcare provider’s main office.

When contacting the billing department, be prepared to provide your personal information and medical details, including the date of service and the type of treatment received. You may also want to have your insurance card and policy information on hand. Be clear and concise about your concerns, and ask questions if you do not understand something.

Filing a Complaint with your Insurance Company

If you are unhappy with your insurance coverage or the way your claim was processed, you have the right to file a complaint with your insurance company. You can typically find the contact information for your insurance company’s customer service or claims department on your insurance card or policy documents.

When filing a complaint, be sure to provide your personal information and policy details, as well as a detailed description of the issue you are experiencing. Be clear and concise about your concerns, and provide any relevant documentation or supporting materials. You may also want to ask for a reference number or case number so you can track the progress of your complaint.

Seeking Help from a Patient Advocate

A patient advocate is a professional who helps patients navigate the healthcare system and ensure they receive the best possible care. Patient advocates can help you understand your medical treatment options, communicate with healthcare providers, and resolve disputes with insurance companies or medical billing departments.

To find a patient advocate, you can contact your healthcare provider or hospital, or search online for local advocacy organizations. When working with a patient advocate, be sure to provide them with your personal information and medical details, as well as a detailed description of your concerns. Be clear and concise about your goals and expectations, and ask questions if you do not understand something.

Filing a Grievance with the State Department of Health

If you believe that your healthcare provider or facility has violated your rights or provided substandard care, you can file a grievance with the State Department of Health. Grievances can include complaints about medical errors, mistreatment, or neglect, among other issues.

To file a grievance, you can typically find the contact information for your state’s Department of Health on their website. Be prepared to provide your personal information and medical details, as well as a detailed description of the issue you are experiencing. You may also want to provide any relevant documentation or supporting materials. Be clear and concise about your concerns, and ask questions if you do not understand something. The Department of Health will investigate your complaint and may take action if they find evidence of wrongdoing.

Negotiating Your Hospital Bill

Understanding Your Insurance Coverage

Understanding your insurance coverage is crucial when it comes to hospital billing. The first step is to carefully review your insurance policy to determine which services are covered and which are not. Most insurance policies have specific limitations and exclusions that you should be aware of, such as pre-existing conditions, deductibles, and co-pays. It is also important to find out if your policy requires pre-authorization for certain treatments or procedures. If you are unclear about your insurance coverage, contact your insurance provider or your hospital’s billing department for assistance.

Researching Average Costs for Procedures

Researching the average costs for procedures can give you a better understanding of what you should expect to pay for a hospital visit. Many hospitals and insurance companies provide pricing information for common procedures and treatments. This information can help you estimate your out-of-pocket expenses and plan for any financial obligations you may have. It is also important to note that costs can vary widely depending on the hospital and location. Therefore, it is advisable to compare prices at different hospitals and speak with your insurance provider about your options.

Requesting a Payment Plan

If you are unable to pay your hospital itemized bill in full, requesting a payment plan can help you manage your expenses over time. Many hospitals offer payment plans that allow you to pay your bill in installments over several months or years. Some hospitals may also offer zero-interest payment plans or discounts for paying in full upfront. It is important to communicate with your hospital’s itemized bill billing department and explain your financial situation to determine the best payment plan for you.

Exploring Financial Assistance Options

If you are struggling to pay your hospital bill, it is important to explore your financial assistance options. Many hospitals offer financial assistance programs for patients who are uninsured or underinsured. These programs may provide discounts, payment plans, or even free services to eligible patients. Some hospitals may also offer assistance in applying for Medicaid or other public assistance programs. It is important to speak with your hospital’s billing department and explain your financial situation to determine which programs you may be eligible for.

Tips for Reviewing Your Hospital Bill

To make sure you catch any errors or overcharges on your hospital bill, it’s important to review it carefully. Start by requesting an itemized bill and double-checking billing codes. Review your insurance explanation of benefits (EOB) to make sure the charges on your bill match the services you received. Finally, keep a record of all communication with the hospital and your insurance company.

Requesting an Itemized Bill

Requesting an itemized bill is an important step in understanding your hospital charges. An itemized bill breaks down the charges for each service you received, making it easier to identify any errors or overcharges. It can also help you verify that you received all the services listed and ensure that you are not being charged for any services you did not receive. You can request an itemized bill from your hospital’s billing department or by contacting your insurance provider.

Double-Checking Billing Codes

Double-checking billing codes is another important step in ensuring that your hospital itemized bill is accurate. Billing codes are used to identify the services and treatments you received and determine how much you should be charged. However, errors in coding can lead to overcharging or undercharging for services. It is important to review your itemized bill and ensure that the codes match the services you received. If you notice any errors, contact your hospital’s billing department or your insurance provider to request a correction.

Reviewing Your Insurance Explanation of Benefits (EOB)

Your insurance explanation of benefits (EOB) is a document that outlines the services and treatments that were covered by your insurance policy. It is important to review your EOB carefully and compare it to your hospital itemized bill to ensure that you were charged the correct amount. If there are any discrepancies between the two documents, contact your insurance provider or the hospital’s billing department to request a correction.

Keeping a Record of All Communication

Keeping a record of all communication is important when it comes to hospital billing. It can help you keep track of any discussions you have had with your hospital’s billing department or insurance provider and ensure that you have all the information you need to dispute any incorrect charges. It is also a good idea to keep a record of any bills, receipts, or other documents related to your hospital visit. This can help you stay organized and make it easier to review your charges and insurance coverage.

When to Seek Legal Assistance

In some cases, you may need to seek legal assistance to resolve a hospital billing issue. For example, if you believe you were the victim of medical malpractice, billing fraud, or denied insurance claims, you may need to consult with an attorney. Out-of-network billing can also be a complex issue that may require legal assistance.

Resources for Understanding Hospital Billing

If you’re struggling to understand your hospital itemized bill or need help resolving a billing issue, there are several resources available. Patient advocacy organizations can provide support and guidance, while state departments of health may have resources for filing complaints or grievances. Consumer reports and government websites may also have information on average costs for procedures and other helpful tips for navigating hospital billing.

Taking Control of Your Hospital Itemized Bill

Understanding your hospital itemized bill and knowing your rights can help you take control of your healthcare costs. By reviewing your itemized bill, disputing any errors or overcharges, and negotiating your bill when possible, you can avoid unnecessary expenses and make sure you’re only paying for the services you received. Advocating for better billing practices and staying informed about your rights and options can also help you protect yourself as a patient.